Consider that you have a cash flow problem after making a sale, but the payment never shows up on schedule. Every company deals with these challenges, which can be tough to handle. In fact, 91% of mid-sized businesses that use automated accounts receivable (AR) systems say they save more money and experience less stress related to their cash flow.

Credit receivables can be a valuable asset for your company if they are handled properly. However, without a clear strategy, unpaid invoices can impact your ability to grow and invest in operations.

In this article, we'll discuss the significance of efficiently managing credit receivables, share practical tips, and guide you through strategies that can reduce cash flow strain and accelerate business growth.

Accounts receivable refers to the money owed to a business by its customers for goods or services provided on credit. It has a direct impact on cash flow and financial stability, making it an essential component of a company's assets.

Understanding the different types of receivables is crucial for efficient management. Trade receivables and notes receivable are the two most common categories.

Businesses can adjust their collection tactics by being aware of the differences. For instance, notes receivable often have defined payback terms, whereas trade receivables could need regular follow-ups.

After discussing the different types of receivables, let's look at how to handle these balances effectively.

Managing credit receivables begins with creating a clear, structured process from the moment an invoice is issued. This guarantees more efficient operations and aids companies in keeping a healthy cash flow.

Clearly defining the terms of payment is crucial to preventing misunderstandings. Common phrases that indicate when a payment is due include "Net 30" and "Net 60." Providing discounts for early payments can also encourage faster payments.

Example: To encourage clients to pay sooner, you can give a 2% discount if the invoice is paid within 10 days. Clear communication of these terms up front makes the process transparent and avoids late payments.

Sometimes, payments are delayed, even when the terms are clear. Here's where follow-ups are useful. Without requiring much manual labor, automated reminders can assist companies in keeping track of unpaid invoices.

For overdue accounts, outsourcing to professional debt collectors, like South East Client Services inc (SECS inc), to handle past-due accounts ensures that collections are managed effectively while preserving positive client relations.

Accurate financial records are ensured by properly applying payments to the customer's account as soon as they are received.

With a streamlined follow-up and payment application system, the next step is understanding how the debts and credits are recorded on your balance sheet.

Maintaining correct financial records and managing credit receivables requires an understanding of debits and credits. These accounting entries guarantee that everything is properly recorded and assist in monitoring outstanding amounts.

When a company gives a customer credit, the amount due is recorded as an asset, and the accounts receivable are debited. For instance, the journal entry for a company that sells something for $500 on credit would be:

This indicates that the business currently has a $500 receivable, which is shown on the balance sheet as an asset.

Credit entries occur when a customer makes a payment or overpays. For example, if a customer overpays by $50, the company needs to apply that credit to future invoices or issue a refund. The journal entry for receiving a payment would be:

This clears the customer's balance. Now that we've covered debits and credits, let's explore how they fit into the larger financial picture in the accounting equation.

Maintaining correct financial records requires an understanding of how accounts receivable fit into the accounting equation. It directly impacts how a company's assets, liabilities, and equity are reported.

In the accounting equation Assets = Liabilities + Equity, accounts receivable is classified as a current asset. It stands for sums owed to the business that are anticipated to be paid within a year and will eventually be turned into cash.

For example, if a business has $10,000 in accounts receivable, the equation would look like this:

Strong financial health depends on effective accounts receivable management. Timely collection of receivables enhances liquidity and makes an effective contribution to the company's working capital. Without effective management, uncollected receivables can negatively impact cash flow and business operations.

Example Calculation:

This shows the effect receivables have on the overall financial structure. Now that we understand how they affect balance sheets, let's discuss how to manage credit balances effectively.

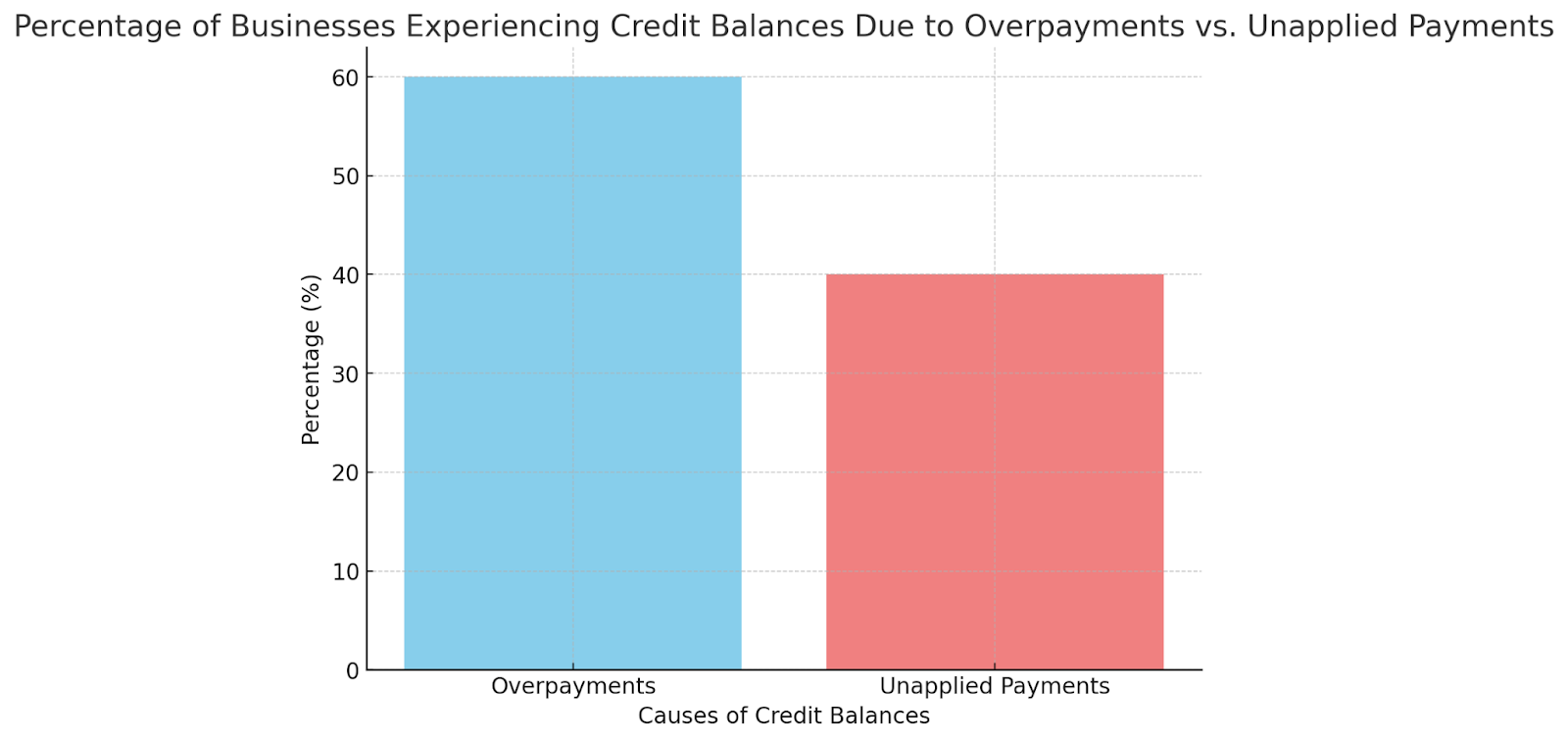

If credit amounts are not resolved immediately, they may make managing accounts receivable more difficult. Overpayments, unapplied payments, or invoicing modifications are often the cause of these balances. Here's how to properly handle them:

Example: If a customer overpays by $100, the business can apply the credit to future invoices or offer a refund.

Once a credit balance is identified, the next step is to apply it correctly to the customer's future invoices or issue a refund. By doing this, financial records are kept updated and correct.

Example: If a customer makes a $200 purchase later and has a $100 credit balance from an overpayment, the $100 credit can be applied to the current invoice. Following that, the client will owe $100 for the current transaction.

Proper reconciliation of credit balances helps maintain clarity in accounts and strengthens customer relationships by ensuring they are credited correctly. Additionally, this procedure avoids confusion and errors in subsequent billing.

Also read: Why Credit and Collections Management Matters for Your Business

Businesses can maintain accurate records and positive customer relationships by managing credit balances properly. Now, let's look at some best practices for more effective accounts receivable management.

Managing accounts receivable efficiently ensures smooth cash flow and financial stability. Businesses can cut down on bad debts, expedite collections, and eliminate delays by putting clear strategies into place.

To prevent misunderstandings, clearly establish the terms of payment at the outset, make sure that both parties agree on expectations, and include these terms on invoices.

For example, offering a 2/10 Net 30 discount encourages faster payments and shortens the receivables cycle.

Set past-due accounts as a top priority to preserve a consistent cash flow. Use a methodical approach that includes prompt reminders and follow-up phone calls.

Consider outsourcing to professional debt collection agencies, like South East Client Services inc (SECS inc), for effective collections while preserving customer relationships.

Use automation tools to streamline the process, track payment due dates, and send automated reminders. By lowering human error, automated payments and reconciliations ensure more accurate financial records.

Businesses can greatly enhance their accounts receivable management by implementing these best practices. Let's wrap up the significance of efficient credit receivables management and how it contributes to a solid financial base.

Effective credit receivables management ensures healthy cash flow and reduces financial stress. Businesses can optimize their accounts receivable process by utilizing automation, prioritizing collections, and establishing clear conditions. These tactics enhance financial stability and guarantee on-time payments.

With their experience in managing past-due accounts, South East Client Services inc (SECS inc) guarantees effective collections without compromising client relationships. Their services can assist companies in managing their receivables more effectively and maintaining a steady cash flow.

Take charge of your credit receivables today. Contact SECS and let their team help you enhance your cash flow and support business growth!