If you’re struggling with debt, you may wonder, What is a debt buyer? How do they operate? You may assume they’re just another type of debt collector—but they’re not. Understanding debt buyers and how they operate can empower you to negotiate with them, protect yourself from potential legal issues, or devise a strategy for dealing with your debt.

But what happens when a debt buyer comes after you? How does this process work, and what rights do you have?

In this article, we’ll break down everything you need to know about debt buyers—how they acquire debts, their tactics, how they differ from debt collectors, and most importantly, how you can defend yourself if they come knocking. Knowing your rights is crucial and can provide a sense of security in these situations. Let’s begin.

A debt buyer is an individual or business that buys past-due or charged-off debt from lenders, including banks or credit card companies, for a small portion of the debt's face value with the intention of collecting it for a profit.

Most debt-buying firms are privately held small enterprises that function in a specialized market or on a state and/or regional level. However, large publicly traded companies are also operational in this business.

They are categorized as "passive" if they hire a collection agency or law firm to collect the debt on their behalf, or "active" if they attempt to collect the debt themselves.

Suppose a creditor cannot collect payment on an outstanding debt after a specific time. In that case, they may try to recover some of the money and reduce their liability by selling the debt to a debt buyer. Depending on the state in which you reside, the lender's laws, and the nature of the debt, this usually occurs after a debt has been past due for 120 or 180 days.

A creditor can transfer the risk to the debt buyer through a debt sale to reach its net collection targets. Then, it can concentrate on its core operations, i.e., day-to-day operations, or new ventures.

Note: Since the original creditor no longer owns the debt, you can no longer make payments to them. Payment plans, if any, must be negotiated with the debt buyer.

Reading your mail is the simplest method to determine whether a debt buyer has acquired your debt. Your original creditors need to tell you when they sell your debt. Moreover, the debt buyer will likely send you a letter confirming that they have purchased the debt.

Checking your credit reports is another option. A company is probably a debt buyer if you notice a debt with your original creditor marked as "charged off" or something similar, and then another company with a debt in the same amount but with a more current date.

Note: Your credit score may suffer significantly if an account is charged off. The charge-off will be recorded on your credit records for seven years after the first delinquency date.

Also Read: Why Credit and Collections Management Matters for Your Business

Confused about how debt buyers operate and what your rights are? Let South East Client Services (SECS) guide you through the complexities of facing debt buyers. Our expert team is here to help you understand your options, protect your financial interests, and confidently navigate the debt recovery process.

Now that you understand what a debt buyer is and why creditors sell debts to them, let’s dive into how these buyers operate and how they make money.

Debt buyers typically buy thousands of debts in bulk sales from original creditors at deeply discounted prices, often paying a very low percentage of the debt's face value, sometimes just cents on the dollar. Let’s simplify their modus operandi through a suitable example:

Example: Let’s say you owe $100 to the original creditor. A debt buyer may buy that debt for $40. Then, they will try to recover $100 from your pockets. If you give them $100, they’ll make a profit of $60.

Furthermore, debt buyers usually don’t do this as a one-off instance. They typically buy many past-due debts at once to improve their chances of making a profit. This is potentially a very profitable strategy.

For instance, if a debt buyer buys ten $2,000 debts for $200 each:

Understanding how debt buyers operate sets the stage for recognizing the key differences between them and debt collectors. Let’s explore that next.

Understanding the distinctions between a debt buyer and a debt collector is essential to mastering the nuances of debt recovery. While both are involved in the collection process, their roles and methods differ significantly. Let’s break it down:

With a clear understanding of the differences between debt buyers and debt collectors, knowing the steps you must take before a debt buyer files a lawsuit against you is essential.

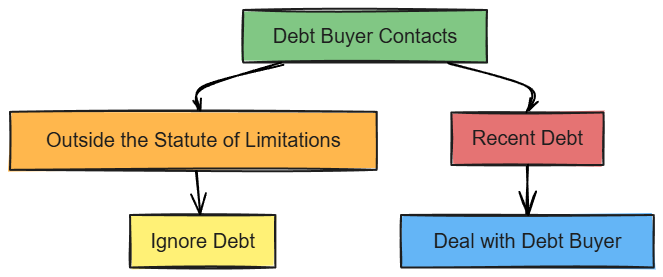

If you’re receiving calls and demand letters from a debt buyer about a legitimate debt but no lawsuit has been filed yet, your first step must be to decide whether to ignore or address the debt.

The above conditional flowchart showcases what you must do when a debt buyer contacts you, based on whether the debt is recent or outside the statute of limitations.

If the debt is outside the statute of limitations (usually 3-6 years), you can ignore the debt buyer's demands. For example, if a $1,000 debt is from 8 years ago, the debt buyer likely can’t sue you because the statute of limitations has expired.

If the debt is recent and you have assets or income that can be seized, you should address it sooner rather than later. For instance, it may be wise to consult an attorney if you have a $5,000 debt with a recent due date and assets to lose. An attorney can help negotiate a settlement where you may have to pay as little as 40-75% of the original debt.

Moreover, you must remember the following tips while dealing with debt buyers.

Debt buyers may offer a new payment arrangement, but be cautious. For example, if you owe $3,000 and agree to pay it off in installments, the debt buyer may report this new arrangement to the credit bureaus. Missing a payment can damage your credit further. Avoid entering this unless absolutely necessary.

Don’t make a partial payment or acknowledge the debt in any way if it’s outside the statute of limitations. Doing so can restart the clock on the statute, and you can face legal action. For example, if you pay $100 on a nearly expired debt, the statute of limitations can reset, allowing the debt buyer to sue you again.

Before taking further action, it's essential to understand your rights under the Fair Debt Collection Practices Act (FDCPA), especially when dealing with debt buyers who may not always be subject to its regulations.

Under the federal FDCPA, debt collectors are limited in their actions while collecting consumer debts. Additionally, the FDCPA gives customers rights and solutions against those who violate its rules.

However, your original creditor is generally exempt from the FDCPA. Additionally, if the person contacting you for the debt collection is a debt buyer, they may or may not be required to abide by the FDCPA depending on certain conditions. Let’s clearly understand them.

According to the Consumer Financial Protection Bureau (CFPB) regulation, as of November 30, 2021, a debt buyer is not regarded as a "debt collector" within the scope of the FDCPA if it:

In other scenarios, the usual limitations apply.

Understanding debt buyers, how they operate, and the key differences between debt buyers and collectors is essential for managing your financial obligations. Moreover, knowing what to do before a debt buyer files suit and when debt buyers are exempt can help you proactively protect your assets and resolve debt issues efficiently.

If navigating these complexities feels overwhelming, don’t worry, South East Client Services (SECS) is here to help. Our expert team can guide you through every step of the process, from dealing with debt buyers to ensuring your rights are protected. We provide customized solutions to help you manage debt effectively while safeguarding your financial stability.

Ready to take control of your debt recovery process? Contact SECS today for professional guidance and a strategic approach to tackling debt buyers.