Financial products such as credit cards and personal loans can make life easier by providing access to credit. However, using credit irresponsibly can lead to financial instability and lower your credit score.

If you've ever faced the stress of having a collection account on your credit report, you're not alone. According to the Household Debt and Credit Report (Q4 2024), household debt hit $18.04 trillion, with elevated auto and credit card delinquency transition rates.

Learning you have an account in collections can be a stressful experience. Ignoring it and hoping it goes away is a disastrous move that can significantly raise your stress levels. So, it's important to understand its intricacies.

While doing so, one of the most frequently asked questions that arises is how long collections stay on your credit report. In this article, we’ll learn more about collections, explore how long they can stay around in your credit report, and how you need to handle erroneous collections. Moreover, we’ll discuss key approaches to managing collection accounts and steps to rebuild your credit.

TL;DR

Collections stay on your credit report for up to seven years. Medical debts have special rules, and errors can be disputed. Managing collections through negotiation or goodwill letters can help rebuild your credit.

When a bill is way past due, the creditor sends it to collections. Debt in collections is also referred to as a collection account. It can indicate financial trouble. Credit cards, utilities, and student loans are just a few of the accounts or invoices that can go to collections.

Also Read: Why Credit and Collections Management Matters for Your Business

The specific procedure that follows a late payment may vary depending on your lender's schedule and regulations. Generally, the creditor follows these stages in the process.

Collection accounts will likely have a negative impact on your credit score, mainly because they pertain to payment history, which is a significant factor in calculating credit scores. Hence, understanding their duration on your credit reports is crucial. This brings up the big question: How long do collections stay on your credit report?

Accounts in collections and late payments often stay on your credit report for up to seven years after the account initially went overdue. Furthermore, the creditor usually charges off the debt six months following the first late payment.

Confused? Let’s understand with an example.

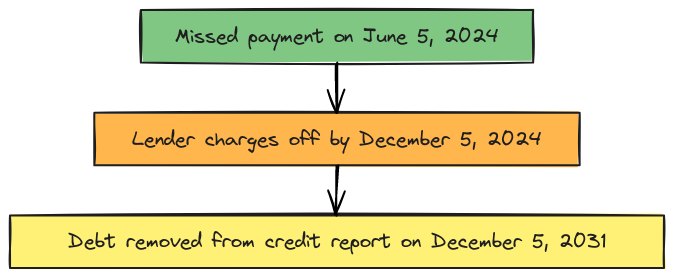

Example: Suppose you missed a payment on June 5, 2024. Your lender will typically charge off your account by December 5, 2024. Therefore, debt will not be removed from your credit report until December 5, 2031.

The above flowchart illustrates the timeline of credit report events and offers a visual guide to the process: from missed payment to debt removal.

Any lender who views your credit report will be able to see the debt's status if it is still outstanding, which can discourage them from offering further loans to you. If you settle the debt after it has been assigned to collections, the account will still appear on your credit report even though the status may be marked as paid. Nevertheless, the impact of this account on your credit score reduces over time.

Did You Know? Residents of New York have a state exception, which says that paid collections are removed from their credit records after five years.

While understanding the duration of collections on your credit report, you need to consider the type of debt. For instance, different rules apply to medical debt.

Credit reports no longer show medical collection debt that’s paid off or had an original reported balance of less than $500. Furthermore, an unpaid medical collection debt will show up on your credit report one year after the date of the initial default. Apart from this, some states have additional laws regarding medical debt.

Depending on the credit scoring model, medical collections may also have a different effect on your credit ratings than other kinds of collection accounts. The reason for this is that more recent credit scoring models like VantageScore 4.0 and FICO Score 9 place less emphasis on the influence of unpaid medical collection accounts on credit scores.

While genuine collections can stay on for seven years, you may face situations where you find inaccurate information on your credit report. What do you do then? Let’s find out next.

You can dispute the debt with the credit reporting bureau and correct the collection account if you think it is incorrect. The Consumer Financial Protection Bureau (CFPB) advises that if the collection agency has erred, you should submit a formal dispute over the debt within 30 days of your first contact. If you do so, they are required to halt collection efforts and can only resume after responding to your dispute.

Make sure you include the following information while raising the dispute:

Moreover, if a collections account is still on your credit report after 7 years, you can file a dispute with the credit bureau.

Also Read: Pre Legal Collections: How Data-Driven Strategies Improve Recovery Rates

Once you learn you have an account in collections, you’ll want to work with the collection agency or the original lender. But, how do you go about it? Let’s explore.

When dealing with collection accounts, it’s crucial to explore your options for managing or potentially removing the collections from your credit report. Here are several approaches you can take to handle these accounts effectively:

One strategy for improving your credit report is negotiating a pay-for-delete agreement with the collection agency. In this arrangement, the collection agency agrees to remove the collection account from your credit report in exchange for full payment.

While there’s no guarantee that the collector will accept this offer, it’s worth attempting if you have the financial means to pay off the debt. Having this agreement in writing is key to ensuring the collection account is removed.

Do you have a collection account weighing on you? Don’t worry, SECS Inc makes it simple! We’ll manage the tough negotiations and make the process effortless for you.

Another approach is to send a goodwill letter to the collection agency and ask them to remove the account as a gesture of goodwill. This is most effective when you’ve already paid the debt and have a history of making timely payments before the issue comes up.

The success of this method depends largely on the relationship you’ve built with the collector and the circumstances surrounding the collection. It’s always worth trying, as some agencies may agree to remove the account out of consideration for your past behavior.

Negotiating a settlement with the debt collector can be your best alternative if you are unable to negotiate a goodwill or pay-for-delete letter. Here's a detailed explanation on how to go about this:

A debt collector must give you detailed information about the debt when they get in touch with you. They should provide you with written confirmation of the debt within five days of the initial correspondence, which enables you to confirm its accuracy.

This validation will also spell out your rights in the event that you need to contest the debt. Ask for more specific information if you are unclear about the amount outstanding or whether you owe the debt.

Once the debt is verified, you can ask for a repayment plan or settle it in full. Examine your finances carefully before making an offer. Ascertain the monthly payment amount that you can afford to make without endangering other financial commitments.

Consider all of your expenses to ensure there is space in your budget for emergencies. Do not accept more than you can afford, whether as a lump-sum payment or a series of smaller payments.

If required, take help from a non-profit credit counselor to evaluate your financial status and create a manageable payback schedule.

Finally, present your repayment plan to the debt collector. Be truthful about your financial status and offer a feasible payment schedule. If you can pay off the debt sooner or in greater amounts, debt collectors can be open to negotiating. Having an attorney helps to deal with the discussions from an expert’s perspective.

Pro Tips:

While you’ll work towards making suitable arrangements for the existing collection, you must ensure that such situations that hamper your credit score don’t occur again in the future. Moreover, you need to take certain proactive measures that will restore your credit score.

Rebuilding your credit after a collection account can feel challenging, but with the right steps, you can gradually restore your financial standing and improve your credit score over time.

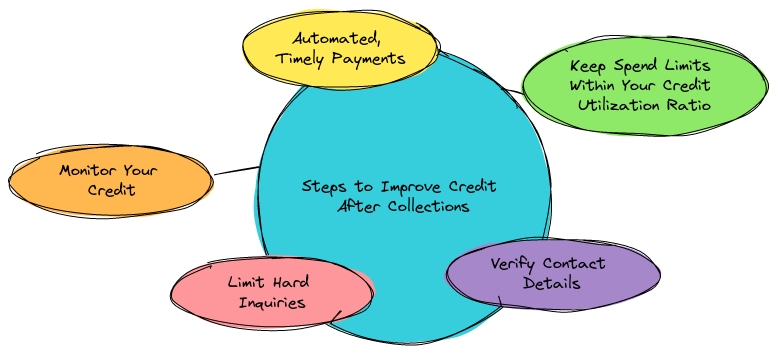

The above illustration outlines the steps involved in the strategic path to restoring your credit health.

Also Read: Effective Credit Control Techniques with Pre-Sales, Post-Sales, & Beyond Strategies

With a robust plan, consistent healthy credit habits, and time, you can navigate through collections to achieve healthier credit and reach the financial opportunities you deserve.

No one wants to have an account in collections, but occasionally we make mistakes or are just short on funds to settle a bill. In such situations, knowing that the collections will remain on your credit report for up to seven years, and managing them effectively is key to recovering your financial health.

Whether you negotiate a settlement, dispute inaccuracies, or adopt good financial habits, you have the power to rebuild your credit and protect your financial future. At South East Client Services Inc (SECS Inc), our expert team works to find solutions tailored to your specific situation, ensuring you peace of mind and full compliance while handling collections.

Facing an unpaid credit card bill in collections? We’ve got you covered! We’ll take care of the tough negotiations and simplify the entire process so you don’t have to. Contact SECS Inc now, and let us help you resolve your debt in a hassle-free manner!

Q. Can paying off a collection account early stop it from being reported to credit bureaus?

A. Not always. Even if you pay right away, agencies may still report your account to credit bureaus once it enters collections. However, you might be able to prevent having it reported if you and the collector agree to a "pay-for-delete" prior to payment. Such agreements should always be obtained in writing in advance.

Q. Will opening a new credit card after settling collections help improve my credit score?

A. It varies. Your credit mix can be diversified by opening additional credit accounts, but doing so may also result in a hard inquiry and shorten the average age of your accounts. Your score may gradually improve if you manage the new account sensibly, keeping balances low and making payments on time.

Q. Are collections for unpaid rent treated differently than credit card debt?

A. Yes. In addition to your credit report, rental collections may also show up on tenant screening reports and often require distinct reporting dates. Even after you've been paid, these can affect your creditworthiness and future rental opportunities.

Q. Do all credit scoring models treat collections the same way?

A. No. While more recent models like FICO 9 and VantageScore 4.0 reduce the influence of paid or medical collections, older models like FICO Score 8 substantially factor all collections. However, not all lenders use updated models, so the impacts may vary.

Q. Can unpaid collections lead to wage garnishment or legal action?A. Yes. Depending on state legislation, the collector may seek bank levies or wage garnishment if they win in a lawsuit and obtain a judgment against you. To prevent escalation, it is best to deal with the debt as soon as possible, whether through payment, dispute resolution, or legal advice.